The Advantages and Disadvantages of the Netherlands 30% Ruling

16 Apr, 2023

What is the Netherlands 30% Ruling?

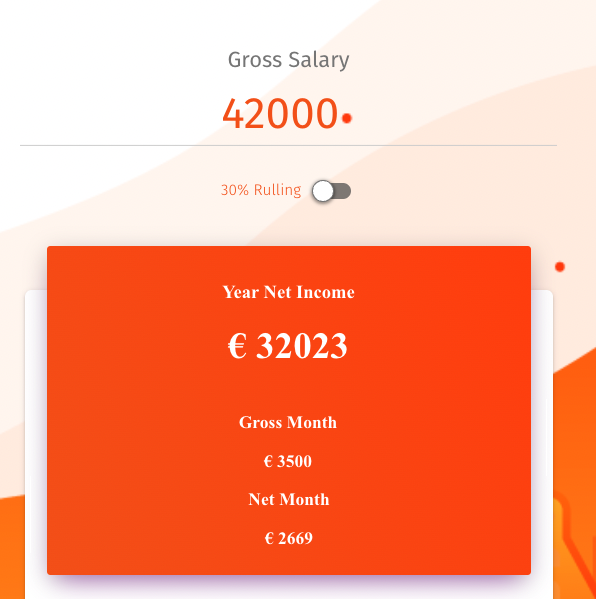

If you’re an expat working in the Netherlands, you may be eligible for the 30% Ruling, which allows you to receive a tax-free allowance of up to 30% of your salary. While this can be a significant financial benefit, it’s important to understand the potential advantages and disadvantages before deciding whether to apply for the ruling.

Duration of Tax benefit

30% facility may be used for only 5 years.

The government has reduced the length of the 30% facility from 8 years to 5 years back in 2019

Advantages of the Netherlands 30% Ruling.

The Netherlands 30% Ruling offers several advantages for expats working in the country. Firstly, it can significantly increase your net income, as you’ll be paying less tax on your salary. This can make it easier to save money or enjoy a higher standard of living.

One of the additional benefits of the 30% ruling in the Netherlands is that you can exchange your foreign driver’s license for a Dutch one without taking a test, regardless of where the license was originally issued.

30 percent ruling allow to exchange the driving license

One of the perks of the 30% ruling is that it enables you to exchange your foreign driver’s license for a Dutch one without the need for a test, regardless of the country where the license was originally issued.

Eligibility criteria for the Netherlands 30% Ruling.

As of 1 January 2023 minimum salary requirments:

Highly Skilled Migrants 30 years or older: € 5.008 Highly Skilled Migrants younger than 30 years: € 3.672

To be eligible for the Netherlands 30% Ruling, you must meet certain criteria.

Firstly, you must be an employee who has been recruited from abroad or transferred to the Netherlands by your employer.

You must also have specific expertise or skills that are scarce in the Dutch labor market.

Additionally, you must have lived more than 150 kilometers from the Dutch border for at least 16 months out of the 24 months prior to your first day of work in the Netherlands.

Requires an application and is not granted automatically

How to apply for the Netherlands 30% Ruling.

Finally, your employer must apply for the 30% Ruling on your behalf and meet certain administrative requirements.

Pension

After 1 January 2015, in principle you do build up pension rights on the tax free part of your salary. This is because due to a system change.

Important : Your application for 30% rulling can be rejected or give only partial benefit

If you and your employer apply for the 30% Ruling, the Dutch Tax Office might decline your application if they cannot confirm your eligibility.

They’ll base their decision not just on your application form but also on supporting documents, such as your payslip or labor contract, which help them determine whether you meet the annual taxable income requirement. To improve your chances of approval, you can also submit other relevant documents along with your 30% Ruling application.

If the 30% ruling is denied, you have the right to file a letter of objection They take 6 weeks for a revision.

Changing employers

If you’re changing jobs within the same company and still qualify for the 30% facility, you don’t need to apply again. Your current decision will remain valid. However, you should confirm with your employer whether the new and previous employers belong to the same company.

If you’re moving to a new employer outside of your current company, you and your new employer can explore the possibility of retaining your 30% facility decision. You can do this if you start your new job within three months of leaving your previous one.

To use the 30% facility at your new employer, you’ll need to apply within four months of starting your new job. If your application is successful, you can start using the tax benefit from your first day of work.

Disadvantages of the Netherlands 30% Ruling.

There are no direct disadvantages you face with accepting 30 % rulling Most of disadvantages are psychological, dealing with loosing it in 5 years. As this significantly decreases the Net income and you have used to certain amount of net salary per month And it is rarely possible to negotiate salary to recoup that amount

Can partner benefit from the 30 percent ruling?

The 30 percent ruling doesn’t apply to your partner’s income. However, you can benefit from an exemption for box 3 taxes on your savings and investments under this ruling.

If you and your partner are fiscal partners, your partner can transfer their savings to you, and these savings will also be exempt from tax.

If partner founds a job after arriving as a partner, they still can’t make use of 30% as it is considers that they found job “locally” Both partners can exchange a foreign driving license if one of the partners has the 30% ruling.

30% Rulling for Self Employed

Whether you can keep the 30% ruling when you become self-employed depends on your specific situation.

The ruling only applies to income from employment, so if you become self-employed, it no longer applies.

However, if you create a limited company that employs you, you can still request the 30% ruling for your work with that company. Keep in mind that this will involve extra administration and costs.

If you combine self-employment with your current job, you may be able to keep the 30% ruling on your employment income, but it can be difficult for your employer to determine and they may not agree to it.

How long application process takes

It can take approximately 2-3 month to get a decision on 30% rulling

Partial Rulling applied

If you don’t hit the minimum requirments of the threshold salary (less than 59,900), you might not fully benefit from 30% tax benefit Certain percantage will be extracted